Look here for more information on the ballot measures! All information provided was created by fellow young voters!

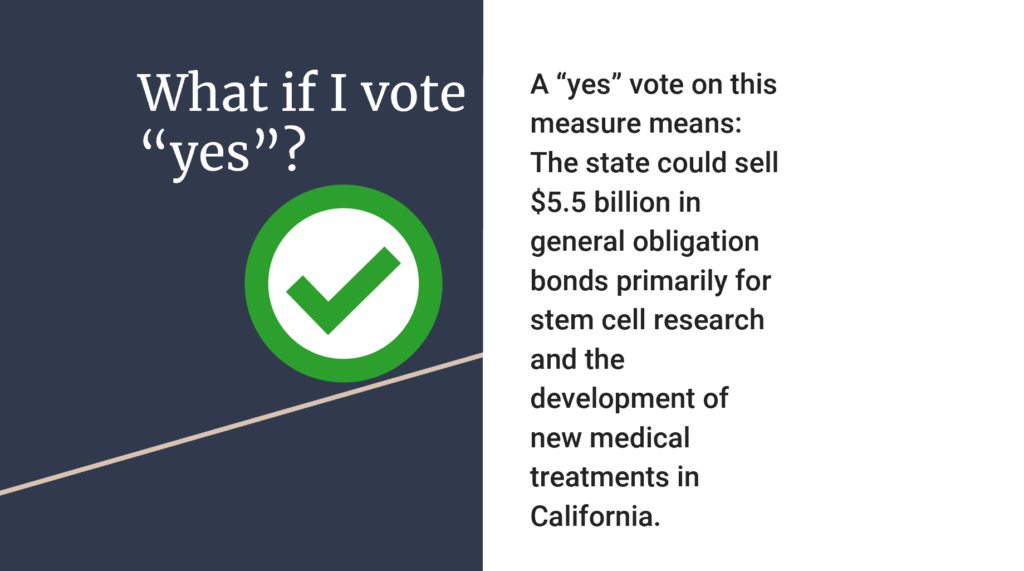

Proposition 14

Authorizes bonds continuing stem cell research

Authorizes $5.5 billion state bonds for: stem cell and other medical research, including training; research facility construction; administrative costs. Dedicates $1.5 billion to brain-related diseases. Appropriates General Fund moneys for repayment. Expands related programs. Fiscal Impact: Increased state costs to repay bonds estimated at about $260 million per year over the next roughly 30 years.

Proposition 15

Increases funding sources for public schools, community colleges, and local government services by changing tax assessment of commercial and industrial property.

Taxes such properties based on current market value, instead of purchase price. Fiscal Impact: Increased property taxes on commercial properties worth more than $3 million providing $6.5 billion to $11.5 billion in new funding to local governments and schools.

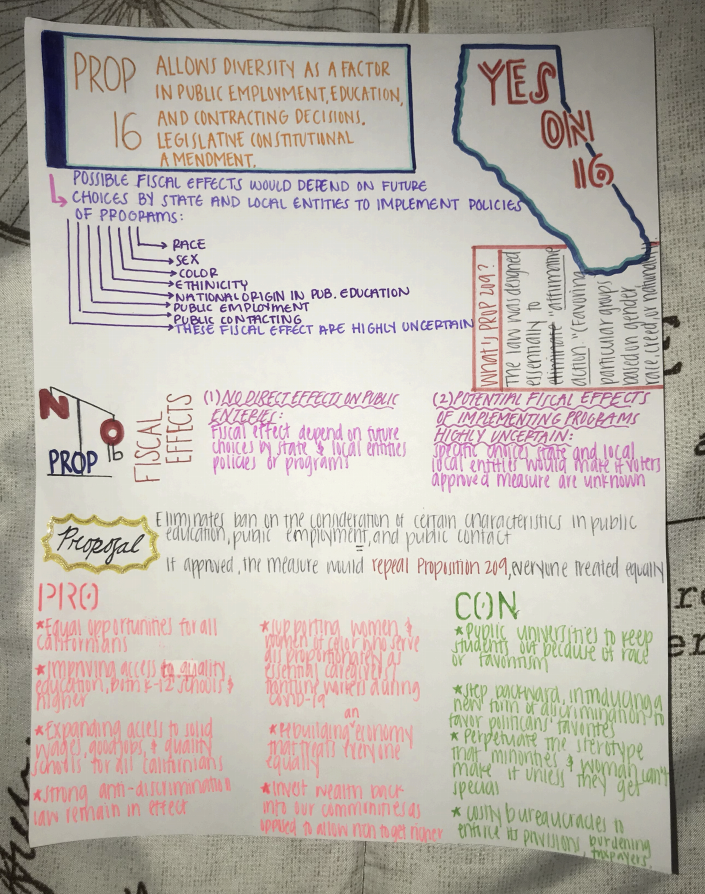

Proposition 16

Allows diversity as a factor in public employment, education, and contracting decisions

Permits government decision-making policies to consider race, sex, color, ethnicity, or national origin in order to address diversity be repealing constitutional provision prohibiting such policies. Fiscal Impact: No direct fiscal effect on state and local entities. The effects of the measure depend on the future choices of state and local government entities and are highly uncertain.

Proposition 17

Restores right to vote after completion of prison term

Restores voting rights upon completion of prison term to persons who have been disqualified from voting while serving a prison term. Fiscal Impact: Annual county costs, likely in the hundreds of thousands of dollars statewide, for voter registration and ballot materials. One-time state costs, likely in the hundreds of thousands of dollars, for voter registration cards and systems.

Proposition 18

Amends California Constitution to permit 17-year-olds to vote in primary and special elections if they will turn 18 by the next general election and be otherwise eligible to vote

Fiscal Impact: Increased statewide county costs likely between several hundreds of thousands of dollars and $1 million every two years. Increased one-time costs to the state of hundreds of thousands of dollars.

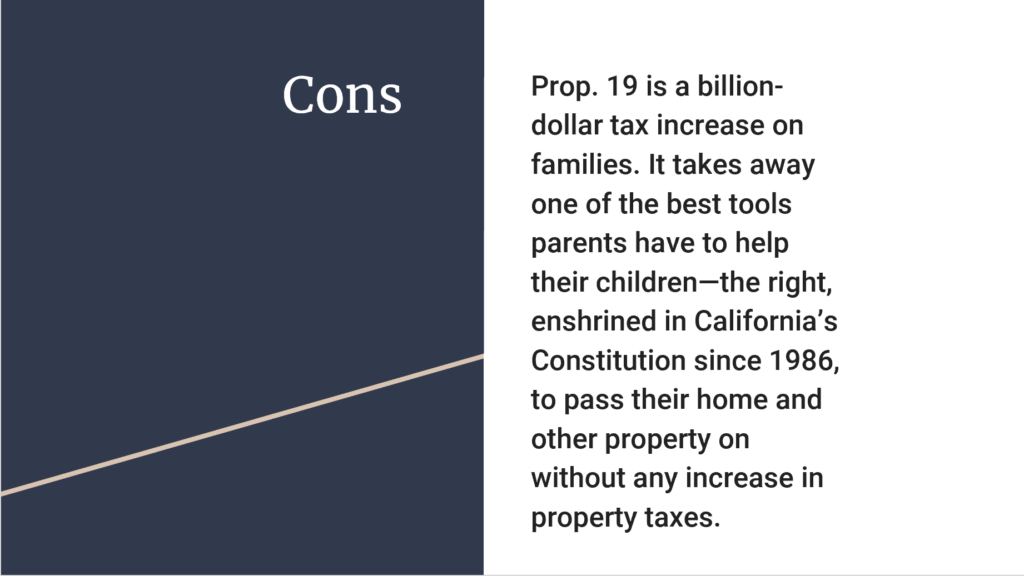

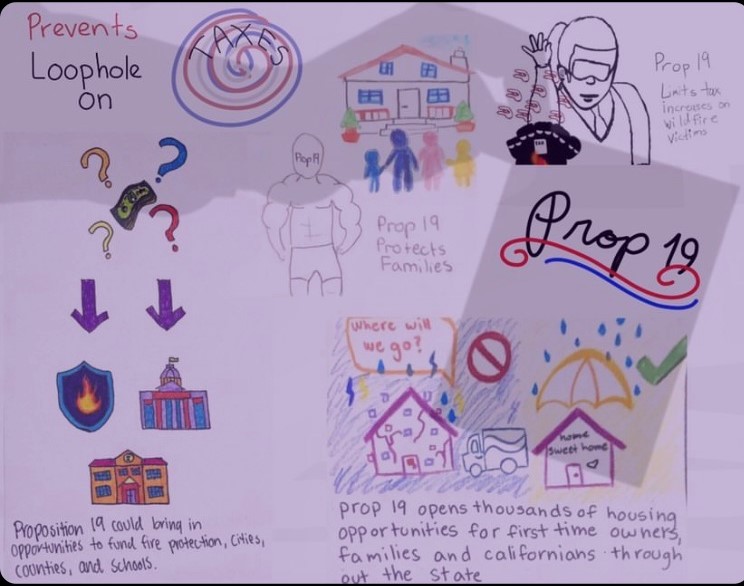

Proposition 19

Changes certain property tax rules

Allows homeowners who are over 55, disabled, or wildfire/disaster victims to transfer primary residence’s tax base to replace residence. Changes taxation of family-property transfers. Establishes fire protection services fund. Fiscal Impact: Local governments could gain tens of millions of dollars of property tax revenue per year, probably growing over time to a few hundred million dollars per year. Schools could receive similar property tax gains.

Proposition 20

Restricts parole for certain offenses currently considered to be non-violent. Authorizes felony sentences for certain offenses currently treated only as misdemeanors

Limits access to parole program established for non-violent offenders who have completed the full term of their primary offense by eliminating eligibility for certain offenses. Fiscal Impact: Increase in state and local correctional, court, and law enforcement costs likely in the tens of millions of dollars annually, depending on implementation.

Proposition 21

Expands local governments’ authority to enact rent control on residential property

Allows local governments to establish rent control on residential properties over 15 years old. Local limits on rate increases may differ from statewide limit. Fiscal Impact: Overall, a potential reduction in state and local revenues in the high tens of millions of dollars per year over time. Depending on actions by local communities, revenue losses could be less or more.

Voting Yes: By voting YES on prop 21, State laws would allow different cities and countries to administer more types of rent control to more properties under the current law.

Voting No: By voting NO on prop 21, state law would uphold current limits set on rent control that cities and countries can apply.

PROS:

- Rent control will help families, children, senior citizens and veterans stay in their homes.

- Prop 21 is fair; it guarantees that landlords can still earn a profit.

- This helps to prevent homelessness.

- Prop 21 would help reduce state and local revenue over time like property taxes.

CONS:

- Rent control laws will cause landlords to evict renters.

- Prop 21 will make housing less available and less affordable at a time when people are struggling to get back to work.

- Rent control leads to less available and less affordable housing.

- Prop 21 could stop houses from being built, hurt people’s jobs and can hurt the economy’s time to recover.

Proposition 22

Exempts app-based transportation and delivery companies from providing employee benefits to certain drivers

Classifies app-based drivers as “independent contractors,” instead of “employees,” and provides independent-contractor drivers other compensation, unless certain criteria are met. Fiscal Impact: Minor increase in state income taxes paid by ride share and delivery company drivers and investors.

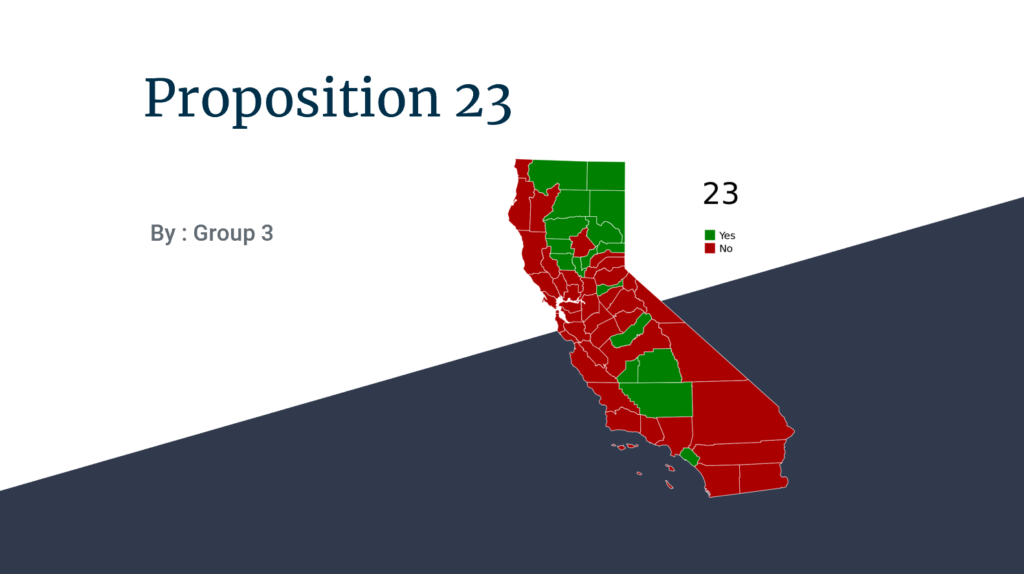

Proposition 23

Establishes state requirements for kidney dialysis clinics. Requires on-site medical professional

Requires physician, nurse practitioner, or physician assistant on site during dialysis treatment. Prohibits clinics from reducing services without state approval. Prohibits clinics from refusing to treat patients based on payment source. Fiscal Impact: Increased state and local government costs likely in the tens of millions of dollars annually.

Proposition 24

Amends consumer privacy laws

Permits consumers to: prevent businesses from sharing personal information, correct inaccurate personal information, and limit businesses’ use of “sensitive personal information,” including precise geolocation, race, ethnicity, and health information. Establishes California Privacy Protection Agency. Fiscal Impact: Increased annual state costs of at least $10 million, but unlikely exceeding low tens of millions of dollars, to enforce expanded consumer privacy laws. Some costs would be offset by penalties for violating these laws.

“CSULA students, when navigating the internet have you encountered any pop-ups in regards to sharing cookies, which carry information from one view website to another. Proposition 24 will progressively strengthen online safety measures. It will allow implementing limitations on businesses from viewing personal information (social security, insurance coverage, location, etc.) Additionally, businesses won’t be allowed to keep personal information for an extensive period of time. Lastly, this proposition would establish the California Privacy Rights Act which would hold companies accountable and inflict penalties when a violation occurs.”

“Prop 24: California Privacy Rights Act gives consumers the authority to control our privacy by preventing businesses/corporations from sharing and using our sensitive information.”

What it means to:

Vote Yes: Support the enforcement of consumer privacy laws and end business privacy violations

Vote No: Opposed to expanding consumer privacy laws

Pros on Voting Yes: If Prop 24 is approved, digital privacy laws will be enforced. This means businesses will no longer be able to sell your personal information. In addition to this businesses will be prohibited from sharing your private information with other businesses. We will be in charge of our own information and where/who it could be accessed and viewed.

Cons on Voting Yes: You have to pay for privacy, so companies would charge their consumers more to keep your personal information sheltered.

Pros on Voting No: You will not have to worry about additional fees

Cons on Voting No: Decrease your privacy rights in California, corporations will continue to track and sell sensitive information.

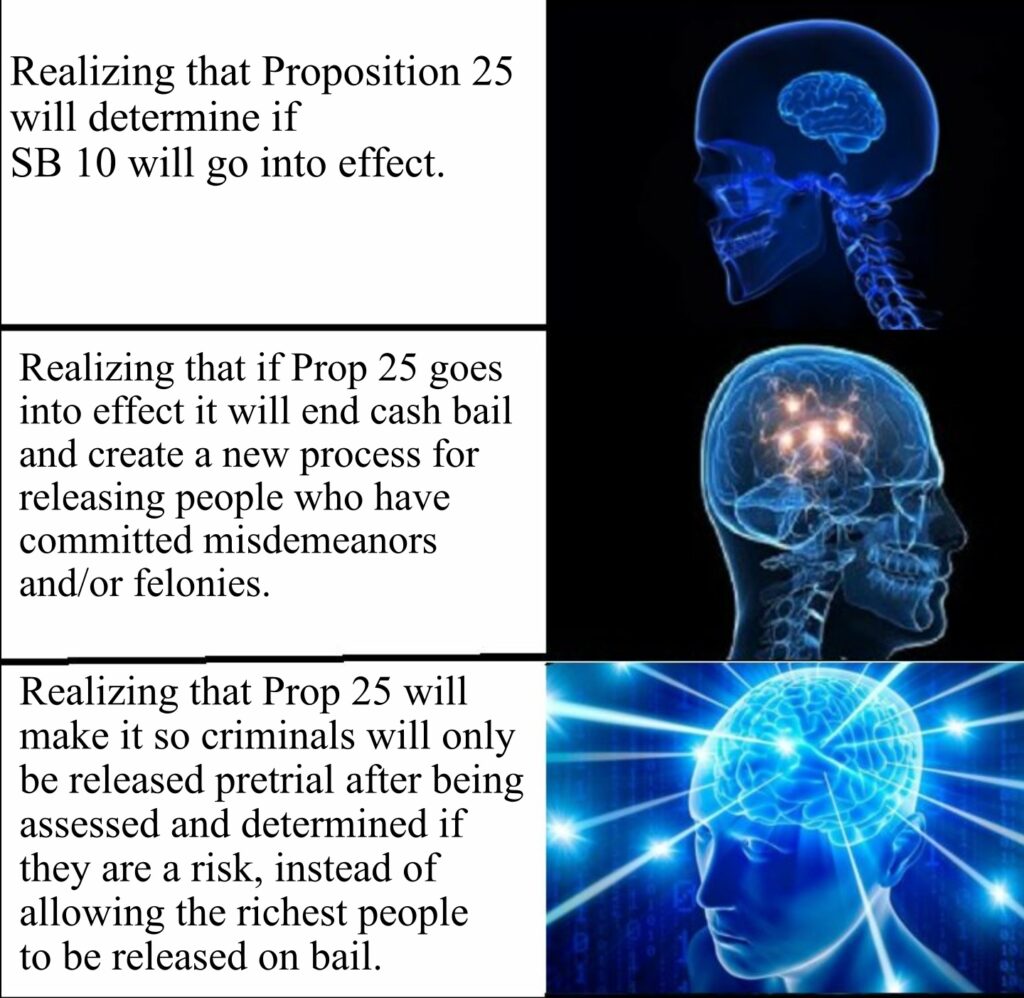

Proposition 25

Referendum on law that replaced money bail with system based on public safety and flight risk

A “Yes” vote approves, and a “No” vote rejects, law replacing money bail with system based on public safety and flight risk. Fiscal Impact: Increased costs possibly in mid hundreds of millions of dollars annually for a new process for release from jail prior to trial. Decreased county jail cost, possibly in high tens of millions of dollars annually.